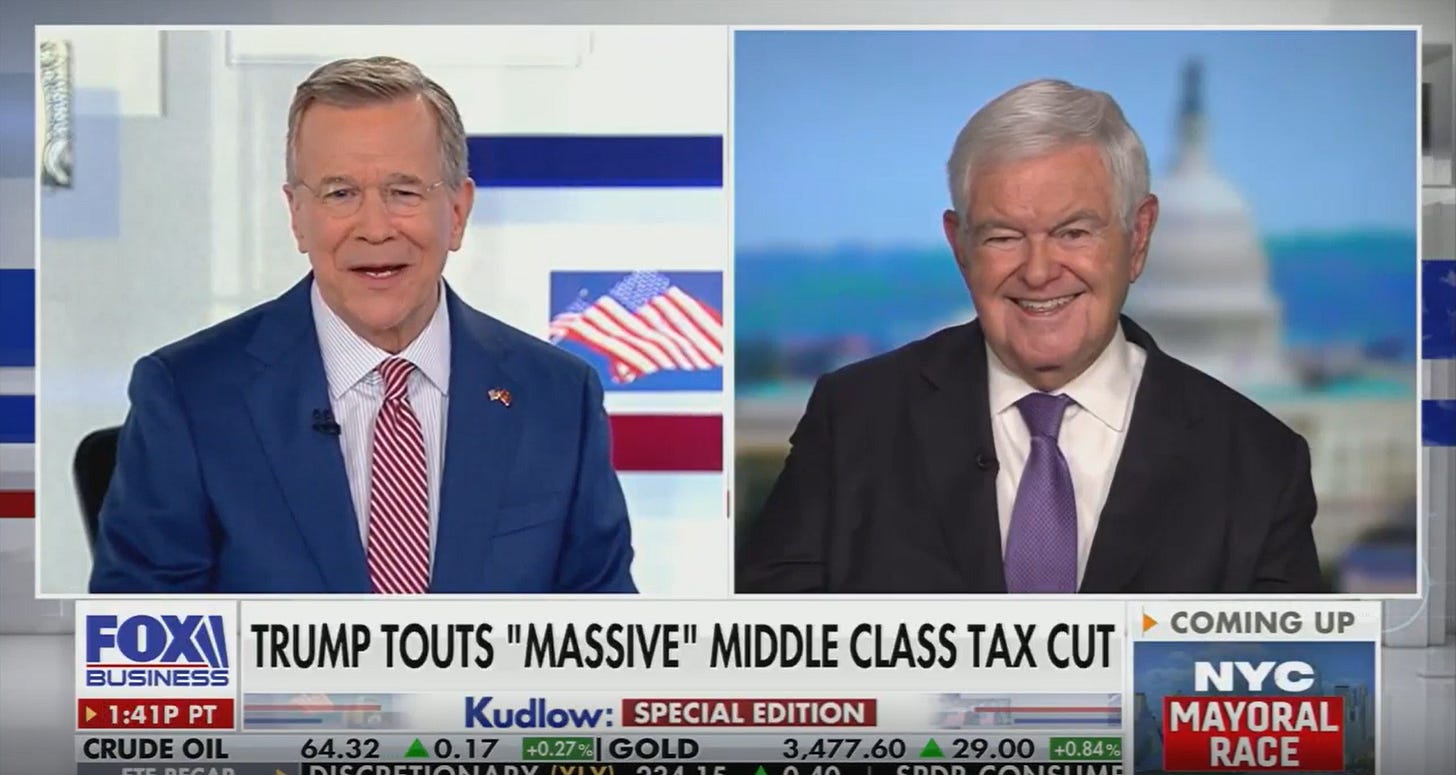

Newt Gingrich discussed the political and economic impact of the new bill. He believes that by summer 2026 the U.S. will likely experience strong growth due to tax cuts, deregulation, increased investment, and reduced government waste. Gingrich highlighted provisions such as stopping Medicaid payments to illegal immigrants and requiring work for able-bodied adults - policies broadly supported by the public.

He argued Democrats’ opposition functioned as support for a massive tax increase. Positive economic signs, like GDP growth of 3.3% and falling mortgage rates, suggest momentum, but confusion over tariffs and negative media coverage have hurt public perception. Gingrich predicts that by early next year, Trump’s economic approval will rebound.

Looking forward, he supports simplifying the tax code (potentially reducing seven brackets to three) and possibly pursuing another major tax reform in 2027–28. He also mentioned potential “rescission” efforts - targeted spending cuts requiring only 51 Senate votes - and expects Republicans to hold the House in the midterms, possibly gaining 10–20 seats.